It’s “damned if you do, damned if you don’t” for the European Central Bank.

It’s “damned if you do, damned if you don’t” for the European Central Bank.

In the coming months, President Mario Draghi and his colleagues will need to decide what to do with a bond-buying plan that is already set to exceed 1.7 trillion euros. Their shopping spree is currently set to run until March. After that they have two options: Extending the deadline at the current pace of 80 billion euros a month or gradually winding down, or tapering, purchases. While quitting cold turkey is theoretically an option, too, it may not be one seriously considered.

The public debate so far has focused on simply lengthening the program. Britain‘s decision to leave the European Union has clouded the outlook for economic growth in the 19-nation euro-area, making additional stimulus more likely as a result. Inflation is still nowhere near the ECB’s goal of just below 2 percent – another good reason to keep buying.

But economists at Goldman Sachs estimate that the ECB risks running out of German debt to purchase at the end of the first quarter, and tinkering with the program’s rules may not add much time.

So, tapering then?

The risks and side effects of ultra-loose monetary policy increase with time, Bundesbank President Jens Weidmann doesn’t tire of emphasizing. Excess liquidity created by QE – the ECB’s balance sheet has never been larger – can raise volatility in asset prices, and squeezes risk premia, for example on peripheral government bonds.

“The risk that quantitative easing becomes irreversible if it is kept” speaks in favor of ending purchases, says Patrick Artus, chief economist at French investment bank Natixis.

But then there are the buts.

If the ECB chose to taper, “it would run the risk of sparking a fresh peripheral debt crisis,” Artus says.

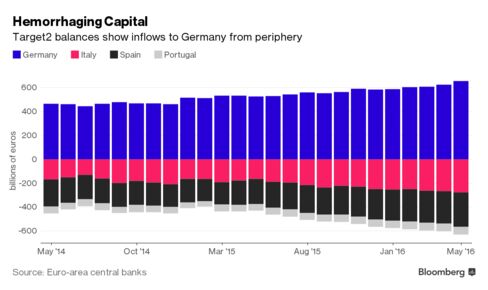

QE helped reduce borrowing costs across the region, making it easier – particularly for more-indebted governments – to manage their liabilities. At the same time, capital mobility between distressed countries and those with more resilient economies such as Germany has remained muted.

“This means that the various countries’ financial markets are segmented,” Artus says. “An end to quantitative easing and to the ECB’s purchases of all countries’ bonds could lead to a sharp widening of the yield spreads between the peripheral and the core countries.”

With budget deficits in many euro-area countries including France, Spain and Italy still wider than the gap appropriate to stabilize public finances, higher bond yields in response to purchases petering out would erode fiscal solvency, he says.

Finally, tapering would also cause the euro to appreciate.

So, Mario Draghi, what will it be?

Bloomberg